SF huge loss, shareholders flee from the two limit

Editor’s note: This article is from the public micro-channel number “20 Club” (ID: quancaijing_20she), Author: Ma Cheng, editor: Yang Jia.

SF Express lost 900 million yuan in the first quarter, which brought a knock-on effect to the most profitable express delivery leader.

Following the one-word limit on Friday, SF Express once again fell the limit on April 12, and its market value has been nearly cut in half since its historical high on February 18, evaporating more than 200 billion yuan.

There is no warning about the huge loss.

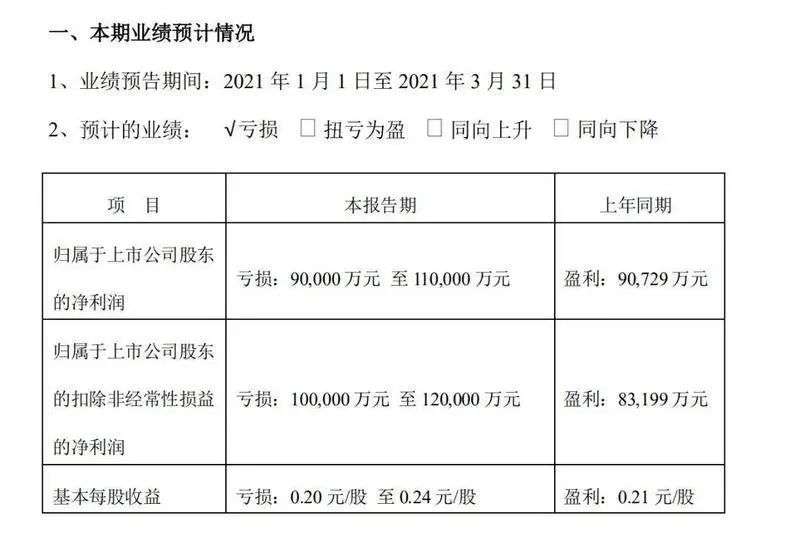

On April 8, SF Express released its first quarter 2021 financial report. The financial report shows that in the first quarter of this year, the company is expected to lose 900 million to 1.1 billion yuan, while in the same period of 2020, the company will make a profit of 907 million yuan under the epidemic. Just last month, SF Express released its 2020 financial report data showing that the net profit attributable to shareholders of listed companies was 7.326 billion yuan, a year-on-year increase of 26.39%.

For this reason, on April 9th, Wang Wei apologized to shareholders at the shareholders meeting: “First of all, I apologize to shareholders, because I think the first quarter really did not manage well.” He admitted that he had neglected in management. , A similar problem will not occur the second time.

Why did SF Express, with thick eyebrows and big eyes, also start to lose money? Various market rumors have been circling around, trying to explain this unexpected incident. Among them, the most gimmicky, and at first glance, the most “ultimate answer” is that taxation and government affairs have brought a fatal blow.

Industry viewpoint Image source/Weibo

But this is not the core of the problem, and it has greatly misjudged the real competitive landscape of the express industry.

What is the real answer? What kind of changes will the express delivery industry, which is mired in price wars, usher in? What is the logic for the decent top student SF Express to choose to join the “introduction”? How to judge the future of SF Express?

01 What happened to SF Express?

After the financial report was released, Wang Wei publicly explained the loss of SF Express.

Shenzhen Stock Exchange releases SF Express loss announcement Photo source/Official website

On the one hand, due to the slower-than-expected growth rate of time-sensitive parts in the first quarter, the expected profits did not appear; the superimposed growth of economic parts caused false high costs and was also part of the reason for the losses.

Previously, the fundamental advantage of SF Express’s stable business lies in its “time-sensitive parts”, which are stable, efficient, and safe, and are basically a must for business products. It has always contributed a high profit margin to SF Express.

There is a view in the industry that due to the conversion of electronic invoices and electronic contracts, the number of corporate orders used for SF Express’s distribution has been greatly reduced.

In this regard, Zhao Xiaomin, deputy director of the Post and Express Special Committee of the Shanghai Transportation Committee, believes that electronic invoices and electronic contracts will not have much impact on SF’s business.

Starting the pilot program of electronic invoicing in 2012, by the end of 2019, a unified national electronic invoicing public service platform has been established, and the country has accelerated the promotion and application of electronic invoicing. This process is constantly advancing and the impact will not suddenly manifest itself. In a certain fiscal season this year.

In the 2020 annual report, SF Express’s time-sensitive parts still achieved revenue of 66.3 billion yuan, a year-on-year increase of 17.41%. The growth rate in the first quarter was not as fast as expected. According to the analysis of various brokerage research reports, there were also reasons for the huge increase in demand for time-sensitive parts during the epidemic last year, which resulted in an abnormally large base.

For the slowdown in growth this quarter, Wang Wei gave two solutions. One is to continue to explore “time-sensitive” customers; the other is to use data to reflect specific scenarios in the supply chain, so as to target different customers. More refined operations. In the next step, SF Express will further optimize the upgrade of time-sensitive products-forming a new product system including SF Express, Express and Standard Express.

If there are obvious decision-making errors in the first quarter, it is the waste of labor costs during the Spring Festival.

In response to the government’s in-situ Chinese New Year policy, the Spring Festival overtime subsidy was close to 1 billion yuan, which was three to four billion yuan more than expected. Wang Wei especially emphasized that the cost of guaranteeing capacity during the Spring Festival is relatively high, and the lack of business volume of time-sensitive products has resulted in a high cost input.

It is worth noting that the 2021 Spring Festival, including Ali, JD, Pinduoduo, and Four Links, are all promoting “not closing”. Delivery as usual during the Spring Festival holiday.

According to all now understand, during the Spring Festival, many express outlets left enough couriers, but the total order volume did not soar compared with previous years. More people stayed in place, but the workload was not saturated. This is undoubtedly Increased company costs.

“This year’s Spring Festival is not closed during the Spring Festival. The momentum is huge, but the results are mediocre. Each company should match according to demand.In grain-producing areas such as Zhejiang and Guangdong, SF Express’s special price has dropped to about 3 yuan for 3 kg. For an average weight of more than 2 kg, SF has taken away many customers who originally belonged to the Tongda system.

E-commerce parts were originally a world of three links and one access, but Cainiao and JD Logistics appeared in the back. While deploying e-commerce, they also continued to impact SF Express’s high-end customers. Previously, when JD Logistics submitted its prospectus, its valuation had exceeded US$50 billion, second only to SF Express in the logistics industry. At the same time, JD Logistics also emphasizes supply chain solutions for 2B business.

“SF Express entered the e-commerce business too late. Not only was it not better than the three links and one access, but also caught up with Pinduoduo and JD.com entering the game. The original advantage was greatly weakened.” Zhuang Shuai think.

In fact, in the field of e-commerce, express delivery companies represented by three links and one delivery have never stopped price wars. Yiwu, a place where the express industry is anxious about competition, has repeatedly exploded the tragic situation of price wars. After the rising star Extreme Rabbit entered the game, the “1 yuan” express was once launched in Yiwu, and the bloody level of the price war set a new record.

At the time of the rise of Taobao, small and medium-sized e-commerce companies blossomed everywhere in Yiwu; Pinduoduo’s rise, and small commodity e-commerce ushered in high-volume growth; last year, the epidemic accelerated the popularity of live streaming and promoted online sales, and the rise of national e-commerce, and Triggered a new wave of turf battles in the express delivery industry.

SF, which has repeatedly failed in the e-commerce market, can no longer miss the opportunity in this wave. In order to expand the business of “e-commerce parts”, SF Express, which has never participated in the express price war, will also join the game of express price war in 2020.

S.F. Holdings Secretary-General Gan Ling once revealed that the cost of the special offer was more than 10 yuan, and the cost in 2019 has been reduced to less than 10 yuan, but there is still a distance from the unit price of 5 yuan for customers. At the beginning of 2020, the target will be set again. Positioning costs are reduced by 50%.

Behind the continuous price reduction, SF Express’s overall profit and single ticket revenue have been affected.

In 2019, SF Express’s overall gross profit margin decreased slightly by 0.5 percentage points from the previous year to 17.42%; in 2020, SF Express’s overall gross profit margin dropped to 16.35%.

From January to February 2021, the business volume of the three links and Yida achieved a year-on-year increase, but the profitability was reduced: the express delivery revenue of SF Express, Yuantong, Shentong, and Yunda was 17.26 yuan, 2.38 yuan, 2.51 yuan, 2.23 yuan, a year-on-year decrease of 12.4%, 19.3%, 23.9%, and 22%.

Although ZTO does not separately disclose single ticket revenue, CFO Yan Huiping said: In 2020, the price of ZTO single ticket has dropped by about 20%.

In order to further reduce costs, SF Express has opened up direct marketing tests and launched another low-priced franchise “Fengwang”. In the second half of 2020, “Fengwang” will enter the testing phase. SF Express revealed at the 2020 financial report: Fengwang broke through the daily average of 100 during Double Eleven in 2020Ten thousand orders, the current business volume is around 1 to 2 million orders per day. “However, Fengwang needs to reach an average of 8 million orders per day to achieve a stable scale, and it is expected to take another 6 to 12 months to continue to advance.” Wang Wei said.

According to user feedback, the price of Fengwang Express has been lowered than that of the three links, but the speed is slow, and it takes 3-5 days to arrive. If you need to speed up the efficiency of e-commerce parts, you can choose another product—— E-commerce Express.

The variables that sink the market include technology and hardware in addition to price.

After 2020, the continuous outbreak of Pinduoduo and live broadcast e-commerce has caused Tongda to increase investment in technology and hardware. At present, Zhongtong has the largest number of factories, self-owned vehicles and automatic sorting equipment in the industry. In 2020, the express delivery industry has experienced “the most invested year over the years, which may be the sum of the previous two years”, Zhao Xiaomin believes.

The previous play style of SF Express has been difficult to bear. For example, SF Express’s “special preferential distribution” was mainly based on the mode of “filling in warehouses”, and there is no need to increase the investment in transportation capacity. However, with the rapid rise of e-commerce parts, SF Express also has to equip e-commerce parts with special warehousing, which is another big expense.

Wang Wei has repeatedly emphasized that “SF Express is only using surplus resources” for e-commerce products. For example, in terms of transportation capacity, after the integration of the four networks, the number and flow of shuttle buses will be more, and the cost for new business use is also the best price-performance ratio.

Actually, in order to gain the right to speak in e-commerce component companies, SF Express still needs to continuously invest in catching up with the three links and one connection. According to the financial report, SF Express is currently adjusting its network construction and integrating it into the express transportation system. In the first- and second-tier and third- and fourth-tier cities, SF Express will newly form different systems to reduce costs and increase efficiency.

“SF’s e-commerce business does not have as obvious advantages as the time-effective business. The Fengwang, which Wang Wei has always emphasized, is slowly spreading, and income restrictions are increasing. But SF’s e-commerce business is correct. Just look at it. How to control costs in one step.” Zhao Xiaomin thinks.

03 Why is the express company worth 60 times PE?

In the white horse stock market last year, the market once pushed SF Express’s P/E ratio to more than 60 times. If you compare it with other peers, you will find how obvious the market’s preference for SF Express is: before this plunge, Zhongtong’s P/E ratio was 33.6 times, Yun was 22.2 times, and Shentong was 29.3 times.

This valuation difference is already a cross-industry gap. Is it just a spillover effect of excess liquidity? In fact, apart from SF Express’s stronger profitability, investors are betting on its future growth to a certain extent.

The statement made by SF’s chief strategy officer Huang Yun at the performance meeting corresponds to this concern.

“Investors focused on SF Express’s time-sensitive products, believing that the scale, growth, and unit price of time-sensitive products are very important factors that affect the stock price. In fact, shareholders are more anxious about when SF Express can produce new businesses and products that can replace them.The contribution status of time-sensitive products to the company’s performance. “

In addition to time-sensitive components, SF Express has been trying to find the second largest growth curve, but SF Express has not yet seen a clear answer for its exploration of new businesses.

According to the 2020 financial report, SF Express’s new business, intra-city express delivery, international and supply chain businesses are all in a rapid growth trend, but this business has a small contribution to SF’s overall revenue, accounting for only about 11% of the overall revenue.

The 2020 annual report disclosed that its total development expenditure for 15 projects including drone projects, international business systems, and Ezhou Airport project management system is 541 million yuan.

The financial report expenditure for the first quarter of 2021 also shows that SF Express has made two major capital investments, acquired Kerry Logistics to deploy international business in its new business, and increased its capital by 409 million yuan in its subsidiary SF Express to develop its intra-city business.

Zhao Xiaomin mentioned that due to the epidemic, part of SF’s investment in new business and technology has been postponed to 2021, which is also an important reason for the loss. In the next step, SF Express will also invest in vehicles in the fields of storage, cold chain and medicine. The number of aircraft will exceed 70, and the aviation hub airport under its subsidiary will also be operated by the end of the year, and scientific research will continue.

There are also many bright spots in the new business. For example, Fengchao Express Cabinet, a product distributed by SF Express terminal. At present, Fengchao Technology has realized the layout of 200+ key cities, 140,000+ communities, and 280,000+ cabinet outlets. The platform has accumulatively registered 4.1 million couriers and serves nearly 350 million consumer users.

The industry once speculated that SF Express will use Fengchao to enter the community group purchase as an intelligent offline pickup point. However, Wang Wei resolutely responded that instead of doing business flow business including community group buying, SF Express still wants to grow an independent third-party industry solution data technology service company.

At present, SF Express has “opened the bow without turning back the arrow”. On the one hand, it is necessary to reverse the sluggish growth of the main business, and make efforts in economic and time-sensitive components at the same time to ensure that 2B business is not snatched away by four links, JD, etc., while continuing to develop e-commerce components and improve 2C new business commercialize. The pains of early investment are necessary.

Zhao Xiaomin is optimistic about the growth of SF Express in 2021. Compared with some friends who stick to traditional business, SF Express is already a very courageous company in the express delivery industry and has been increasing investment in new business. In his view SF Express is in the stage of accumulation and precipitation. Its strength in logistics and technology for many years is worth looking forward to. The market should give it more patience.