Cloud computing has been developing rapidly for 20 years, and the listing of Jinshan Cloud may mark the acceleration of the post-epidemic era.

Editor’s note: This article comes from the WeChat public account “Bay Area Box CLUB” (ID: BayboxClub) , author : Zgcgdg.

Bay Area Box BAYBOX original

Author | DONG

Edit | XUGUOGUO

On May 8, another new IPO project of “Lei Jun Department” was born.

Jinshan Cloud successfully landed on the Nasdaq Stock Exchange as originally planned. The IPO (Initial Public Offering) issue price was US $ 17 and the opening price was US $ 20.37. One hundred million U.S. dollars. The underwriters are JPMorgan Chase, UBS, Credit Suisse and CICC.

Jinshan Cloud is the second listed subsidiary that was spun off from Lei Jun Department of Jinshan Software (03888.HK), and another subsidiary of WPS and other office software companies, Jinshan Office, has been in Science and Technology Board in November 2019. Go public. So far, the “Lei Jun Department” already owns four listed companies including Kingsoft, Xiaomi Group (01810.HK), Kingsoft Office, and Kingsoft Cloud.

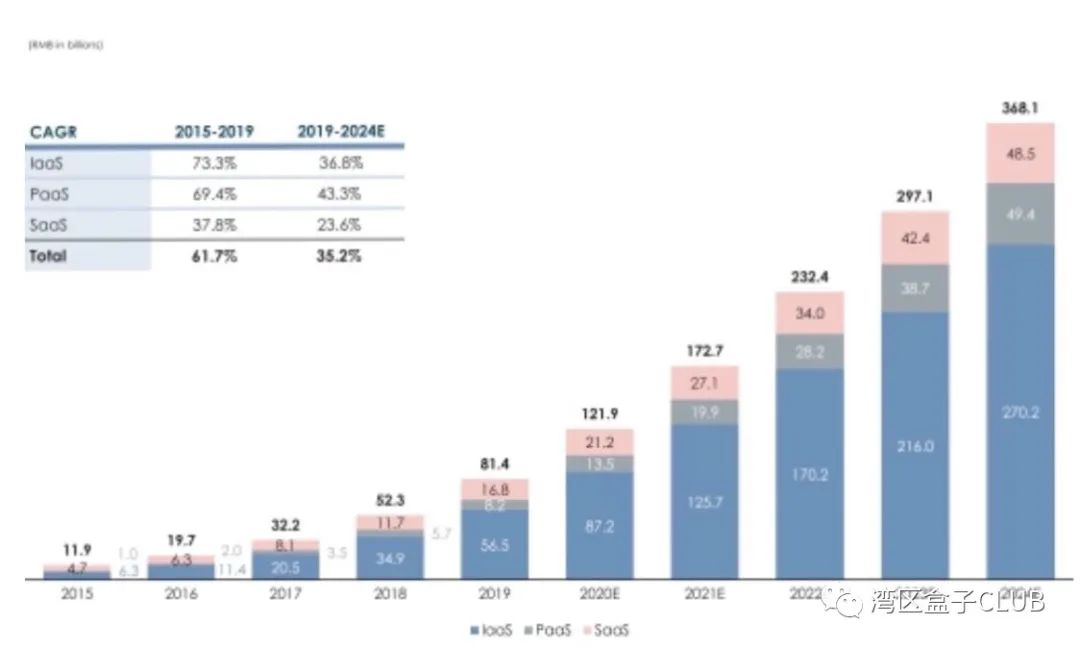

According to Jinshan Cloud’s listing document, citing data from research institute Frost & Sullivan, the company has achieved an average annual compound growth rate of 79% in the past three years and is the third largest Internet cloud service provider in China, accounting for IaaS and PaaS public cloud services in 2019 The market share of revenue is 5.4%.

Not only Jinshan, but the global market, the entire cloud computing industry has maintained rapid growth over the past 20 years. As the two largest cloud computing markets in the world, the United States and China have maintained compound annual growth rates of around 20% and 30%, respectively.

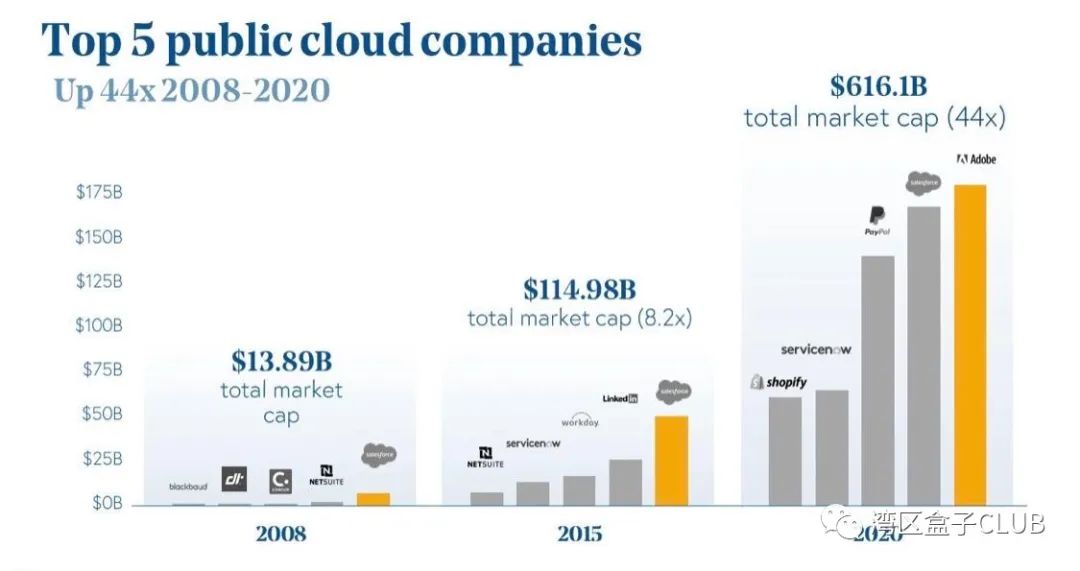

From the perspective of enterprise size, the number of unicorn companies in the world’s public and private clouds now exceeds 140. From 2008 to 2020, the value of the top five public cloud companies (excluding Amazon and other integrated super platforms) increased 44 times, and the total market value exceeded 600 billion US dollars.

The current epidemic has not completely dissipated, but this extreme public health crisis has made many enterprises and related institutions see that business cloudization and digital transformation are no longer an option, but a mustneed. The battle between the IPO market and the major platforms in the cloud computing field has also become a key battlefield that we must focus on in 2020.

Jinshan Yun ’s independent story

The main storyline described by Kingsoft Cloud to NASDAQ investors revolves around “China’s largest independent cloud service provider.”

In the listing document, Kingsoft Cloud stated, “The definition of an independent cloud service provider does not belong to any large enterprise group provider that involves a wide range of businesses that may compete with customers. Potential conflicts of interest and competition between them and customers Limited, and therefore entrusted by customers “. Based on this, Jinshan Cloud differentiated itself from Alibaba Cloud and Tencent Cloud. According to Frost & Sullivan, Jinshan Cloud is China’s largest independent cloud service provider.

Considering that Jinshan Cloud ’s scale is not superior to platform companies such as Alibaba Cloud and Tencent Cloud, the “independent cloud service provider” that Jinshan Cloud came up with is indeed a good label. (Jinshan Software, Jinshan Office, Xishanju, Xiaomi mobile phone, etc.), this “independence” may just be a relative concept.

Just like other Chinese stock companies, Kingsoft Cloud has shown a super-growth Chinese cloud computing market to US investors.

Jinshan Cloud divides customers in the Chinese cloud service market into two categories, one is Internet companies and the other is traditional companies and public service organizations.

In terms of scale, China ’s Internet cloud market is 53.8 billion yuan in 2019, and it is expected to reach 217.5 billion yuan by 2024, while the Chinese cloud computing market for traditional enterprises and public service organizations is even larger. It is expected to reach RMB 345.9 billion by 2024.

Among them, in the market of traditional enterprises and public service organizations. In 2019, compared with 49.4% of traditional enterprises and public service organizations in the United States that are using cloud services, the proportion in China is only 10.5%. Coupled with the introduction of economic boost policies such as new infrastructure after the epidemic, cloud service providers such as Kingsoft Cloud are facing huge opportunities brought about by cloud migration.

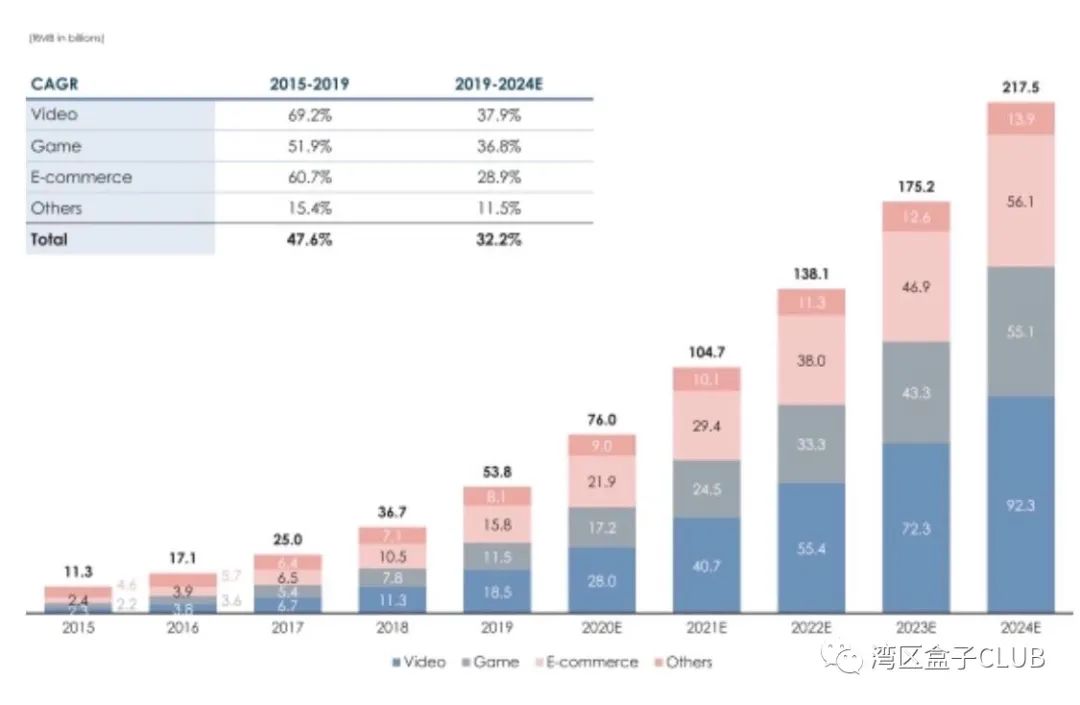

In addition, Kingsoft Cloud strategically attaches great importance to the huge growth space of vertical industries such as games, video and financial services in the Internet field.

In the field of games, Kingsoft Cloud began to provide game cloud solutions as early as 2014, when the mobile game market had just begun to grow exponentially. As of December 31, 2019, Jinshan Cloud has provided game cloud solutions for game companies such as Giant Network, Perfect World and Xishanju.

In the field of video. Kingsoft Cloud stated that it had provided video cloud solutions long before the explosive growth of the Chinese video industry, that is, in 2016. This field is now the hottest track in China and even the global market. Jinshan Cloud’s customers include mainstream video platforms such as ByteDance, iQiyi and B Station. In the customer case, Jinshan Cloud specifically took the B station and byte bounce as examples. These two companies are already familiar to American investors and have been recognized.

Jinshan Yun also specifically mentioned the synergy with strategic shareholders such as Jinshan Group and Xiaomi in the prospectus.

Jinshan Cloud uses the ecological network of Jinshan Group and Xiaomi to cross-sell, and both are also customers of Jinshan Cloud. However, in the past three years, the share of these two companies in Jinshan Cloud’s business revenue has continued to decline. Among them, the total revenue of Jinshan Group accounted for 4.0%, 3.5% and 2.8% of the total revenue in 2017, 2018 and 2019, respectively. The total revenue of Xiaomi accounted for 27.0%, 24.6% and 14.4% of the total revenue in 2017, 2018 and 2019 respectively.

Jinshan Cloud has a large proportion of large customers in the customer market. This should be a big difference between Jinshan Cloud and BAT.

As of December 31, 2019, Kingsoft Cloud has 4,244 customers in many industries including games, video, artificial intelligence, e-commerce, education, financial services, public services, and healthcare. The total number of high-level customers increased from 113 in 2017 to 154 in 2018, and further increased to 243 in 2019. “As a result, we have obtained a large portion of revenue from large customers. Our senior customers accounted for 93.7%, 95.3%, and 97.4% of total revenue in 2017, 2018, and 2019, respectively.

The high proportion of large customers certainly indicates that the customer base is relatively high-quality, but the instability caused by excessive income concentration is also worthy of vigilance.

Jinshan Cloud Prospectus shows that as of December 31, 2019, Kingsoft had $ 290.6 million in cash and $ 358.2 million in total liabilities. Free cash flow for the twelve months ended December 31, 2019 was negative.

Jinshan Cloud needs to continue to prove to the market that it is profitable as soon as possible while maintaining revenue growth.

The place where unicorns emerge

Before the listing of Jinshan Cloud in the global capital market, according to Reuters, another cloud computing company, Rackspace, has also secretly submitted an initial public offering (IPO) application. The company ’s valuation is almost twice that of Jinshan Cloud, which may exceed 10 billion US dollars.

The company was privatized by Apollo Global Management for $ 4.3 billion in 2016. Previously, the company mainly operated managed private clouds based on technologies such as OpenStack, Microsoft, and VMware, but soon after it was acquired by Apollo, he began to enter the public cloud service field. He also bought a number of companies to accelerate this transition, including TriCore Solutions, Datapipe, and cloud-native consulting and hosting services company Onica. Now, Rackspace has begun to provide public cloud services like Amazon AWS, Microsoft Azure, and Google.

According to Reuters reports, in 2019, the public listing of the two companies Fastly and Datadog was another factor that stimulated the listing of Rackspace.

Fastly was founded in 2011 and is headquartered in San Francisco. It is a CDN service company that provides network acceleration, performance optimization, and security protection. Last May, Fastly was successfully listed. After him, Datadog also successfully listed, the market value of more than 10 billion US dollars.

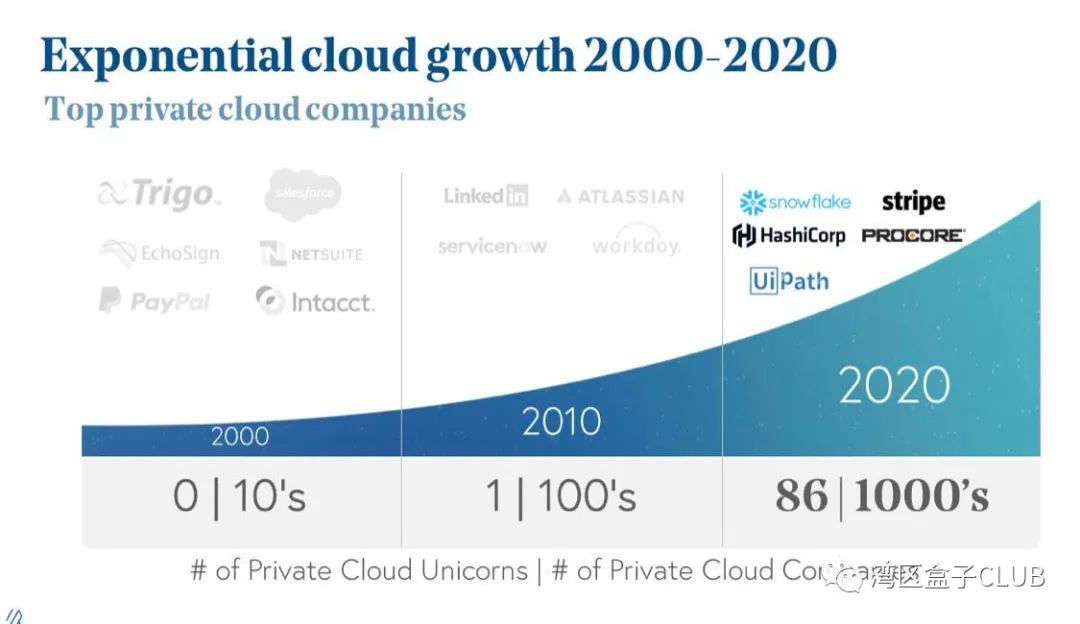

Looking back at the past two decades of the 21st century, the development of cloud computing is amazing, especially in the global innovation and entrepreneurship market. So far, more than 140 unicorn companies with a market value of more than 1 billion US dollars (including publicly owned companies) Cloud and private cloud), which includes Kingsoft Cloud and Rackspace.

According to the statistics of investment agency Bessemer, in the public cloud market, the number of unicorns with a market value of more than 1 billion US dollars developed rapidly after 2007. When Netsuite was successfully listed that year, the cloud penetration rate of corporate users began to increase rapidly thereafter.

In 2010, there were 12 listed unicorn companies. By early 2020, this number had reached 55. Among the more than fifty listed companies, the market value of the five major giants such as Salesforce, Paypal, ServiceNow, Shopify, and Adobe all exceeds US $ 50 billion.

From 2008 to 2020, the value of the top five public cloud companies increased 44 times. In 2008, the total market value of Salesforce, Netsuite, Concur, Blackbaud and Dealertrack totaled $ 13.89 billion. By 2015, with the addition of LinkedIn, ServiceNow, Salesforce and Netsuite, the total market value of the new top five public cloud companies has increased by 8 times. By February 2020, the market value of the top five public cloud companies had exceeded US $ 600 billion.

In the private cloud market, unicorns have also grown exponentially.

In 2008, the valuation of private cloud company LinkedIn reached more than $ 1 billion, making it the first unicorn in this segment. As of February 2020, there have been more than 86 private cloud unicorns, including HashiCorp, UiPath, Snowflake, Stripe, Toast, Procore and other companies.

In the Chinese market, in the past two years, with the gradual disappearance of consumer Internet dividends, major investment institutions have bet on corporate services and industrial Internet markets, and this market is also the main battlefield for cloud computing companies.

Previously, cloud computing unicorns such as Jinshan Cloud, Youkede, Qingyun, and Yuncong Technology have all received much attention.

At the beginning of this year, Youkede (stock code: 688158) has been officially listed on the Science and Technology Innovation Board of the Shanghai Stock Exchange, becoming the first Chinese cloud computing stock. Today, Jinshan Cloud has landed on Nasdaq again. Who will be the next cloud computing unicorn to be launched?

Ding Hai Shen Zhen of platform enterprises

While many unicorn companies are emerging, cloud computing services have also become a number of platformsThe main source of profits for giant companies. Now under the capital trend during the epidemic, cloud computing business has even become the pin of Dinghaishen for several major platform companies to stabilize their “platform”.

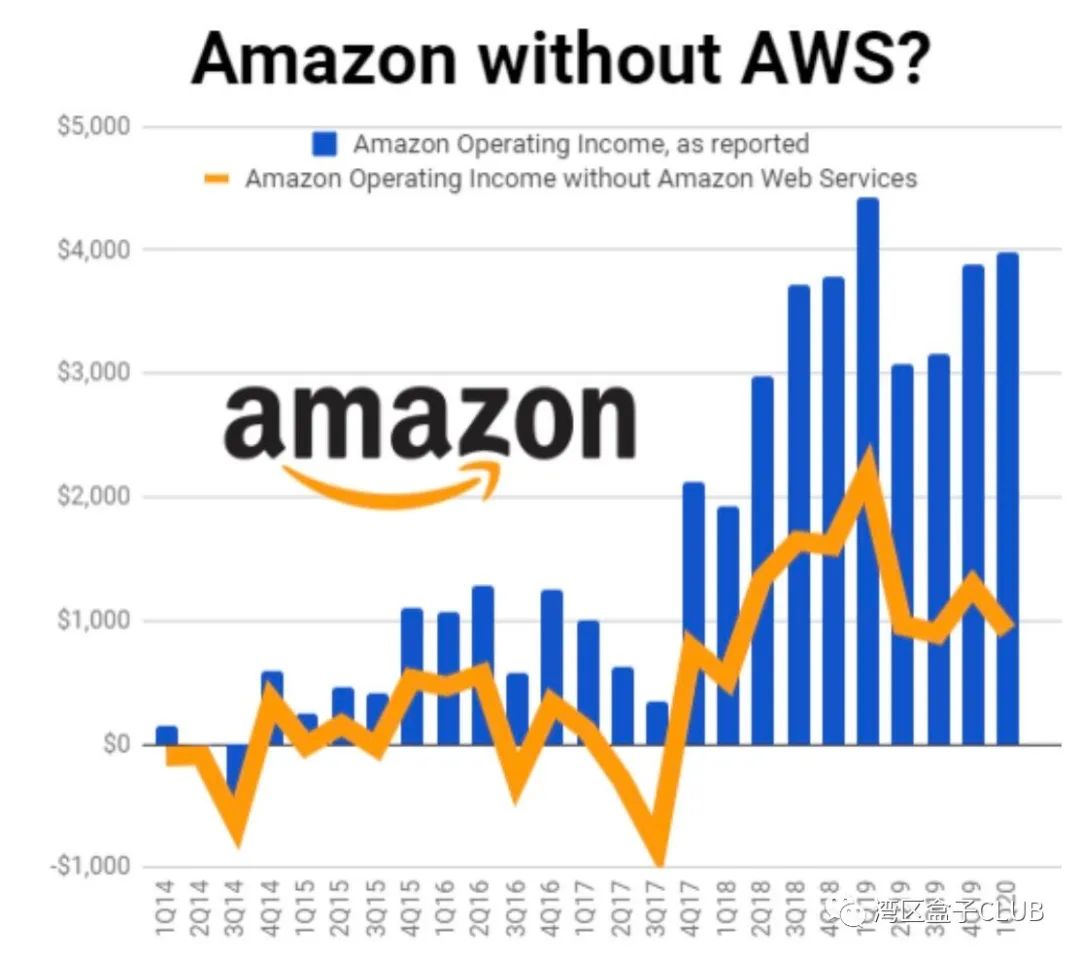

In the first quarter of 2020, AWS contributed most of Amazon ’s operating profit, and the analysis believes that this provides a good financial buffer for Amazon ’s stock decline during the epidemic.

According to public data, this technology giant ’s cloud computing business accounted for more than 77% of Amazon ’s total operating profit in the first quarter, the highest percentage in two years. During the first quarter, Amazon ’s total operating profit fell by 10% to $ 4 billion, but without AWS, the company ’s operating profit may be less than $ 1 billion.

In addition to Amazon, companies like Apple, Microsoft, and Google are almost the same.

Also in the first quarter of the past, Microsoft ’s commercial cloud revenue increased by 39% to $ 13.3 billion, accounting for 38% of the company ’s total revenue of $ 35 billion in the third quarter. The commercial cloud includes the commercial version of Office 365, Microsoft Azure and LinkedIn, Dynamics 365 and other commercial parts of the Microsoft cloud business.

Apple ’s service revenue for the quarter reached a record $ 13.3 billion, more than double the total Mac and iPad sales revenue, and accounted for nearly 23% of the company ’s $ 58 billion in total quarterly revenue. Apple’s services are basically cloud services, including digital content and streaming media, AppleCare, iCloud and so on.

At Google, Google Cloud revenue grew 52% to $ 2.78 billion in the first quarter. Compared with Google ’s parent company Alphabet ’s quarterly revenue of $ 41 billion, the cloud computing business accounted for less than 7%. Compared with the company ’s online advertising business, the cloud computing business is indeed small in scale, but in terms of growth rate See, it is becoming a key area of growth. In addition to business growth data, this can also be seen from the importance of Google’s top management.

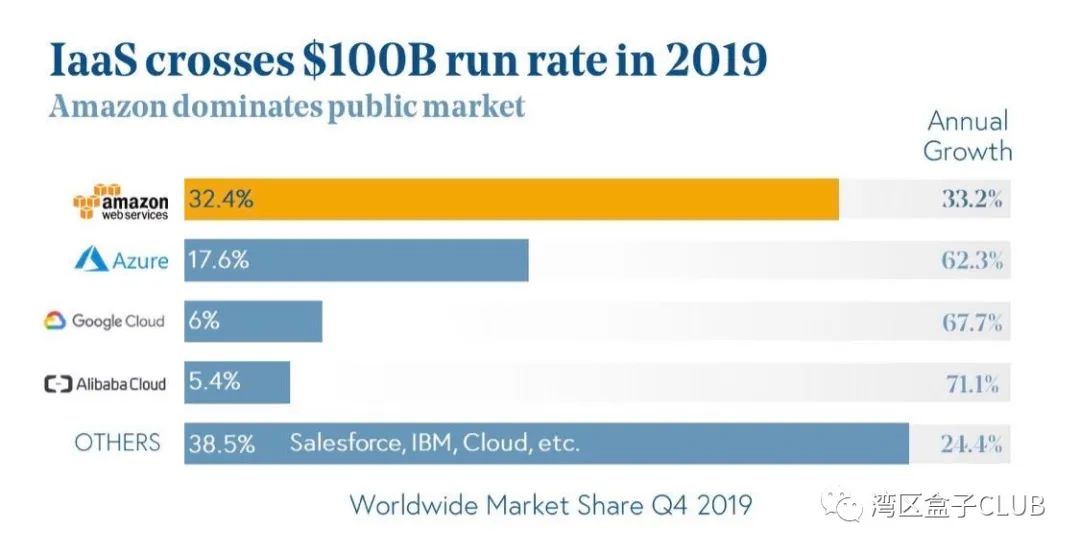

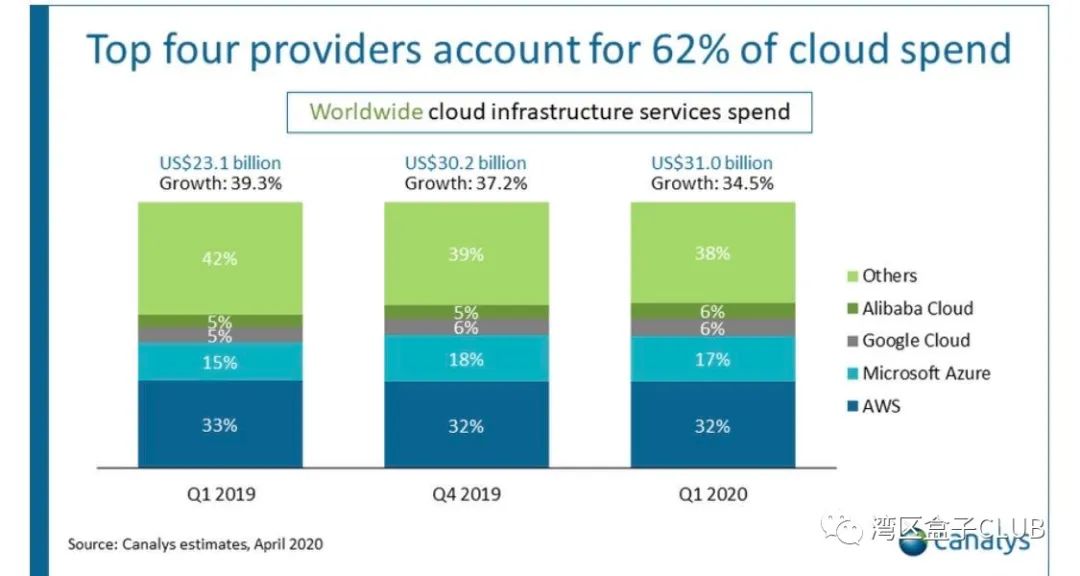

In the key IaaS market, Amazon continues to dominate the public market. AWS maintains an annual revenue of US $ 40 billion (and continues to grow at a compound annual growth rate of 30%), while generating billions of dollars in profits. But after him, Microsoft’s Azure is rapidly rising, with a market share of 17.6% in 2019, higher than 14.2% in 2018, and it continues to grow at a faster rate. Obviously, AWS and AzurThe gap between e is closing.

In China, Alibaba just announced recently that it plans to invest 200 billion yuan ($ 28 billion) in its cloud computing department in the next three years.

The cloud computing business unit is one of Alibaba ’s fastest-growing businesses: In the fourth quarter of 2019, cloud revenue grew 62% to more than 10 billion yuan. According to data from research firm Canalys, Alibaba accounted for 46.4% of the Chinese cloud market in the quarter.

According to analysis agency Wedbush, the recently announced investment should be a major strategic move of Alibaba. Although Alibaba’s cloud business has achieved strong growth in the past year, it only accounts for less than 10% of total revenue. The industry expects that Alibaba Cloud’s business revenue will double in the next few years.

In the Chinese market, although Alibaba has a nearly 50% share, the competition it faces is becoming increasingly fierce. From Amazon China and Tencent to JD.com and Baidu are all working on related businesses.

For example, Tencent Cloud has recently intensively released services in various sub-sectors such as blockchain, audio and video, and intelligent identification, which is showing Tencent Cloud in infrastructure, underlying platforms, service platforms, application components, and industries. The layout of full links such as applications.

Cloud computing is a typical winner-takes-all market, and the competition among platform companies will only become more intense. The chances of other new entrants being strangled by the platform (including acquisitions, of course) have also greatly increased.

Cloud computing devours the world

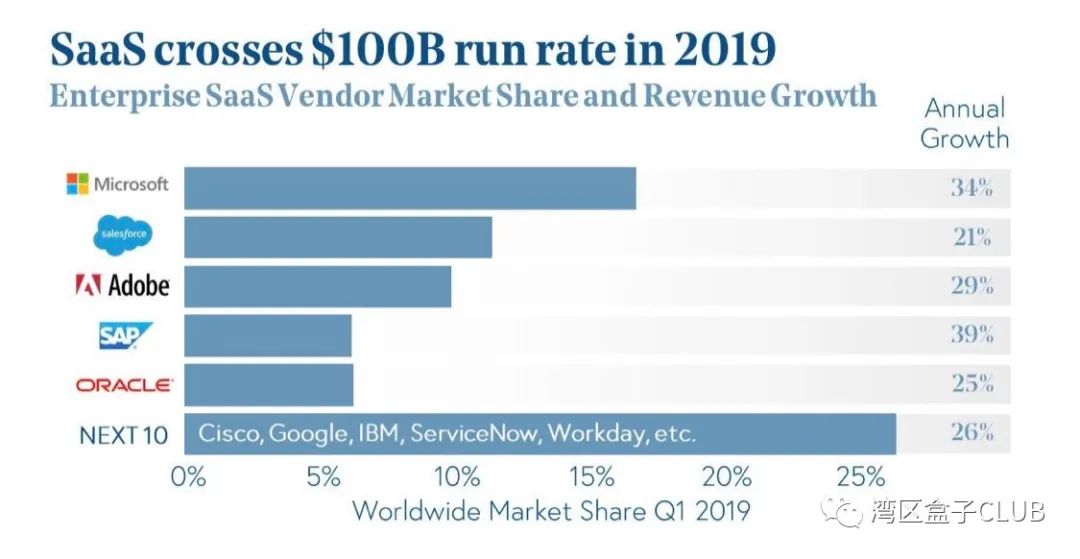

From the perspective of the trillion (dollar) market of cloud computing in 2020, we find that both the IaaS and SaaS markets have exceeded US $ 100 billion in 2019.

According to the 2020 market research report of Allied Market Research, the global market value of all types of cloud services will reach US $ 265 billion in 2019, and it is expected to reach US $ 928 billion by 2027. The main driving force for this expected growth is the large-scale continuous transition of global enterprises from local systems to cloud environments, and the continuous innovation of cloud system products by service providers.

Cloud computing is actually reducing the deployment costs of enterprise users and improving the operating efficiency of enterprises. Especially in the epidemic, the surge in demand for online collaboration tools, e-commerce, and consumer cloud services has led to a sharp increase in cloud infrastructure consumption. For suppliers, the Cloud Computing InstituteThe recurring income (monthly service fee, annual service fee) brought about is more sticky, and the business stability is greatly increased.

In the post-epidemic era, whether in the global or Chinese market (new infrastructure), a new wave of economic stimulus measures is directly promoting the rapid growth of cloud computing business. But on the other hand, enterprise users will be more sensitive to costs after being hit during the epidemic, and will likely stop spending other than the most important IT expenses.

For this reason, Microsoft and Amazon have warned of this uncertainty in their external statements.

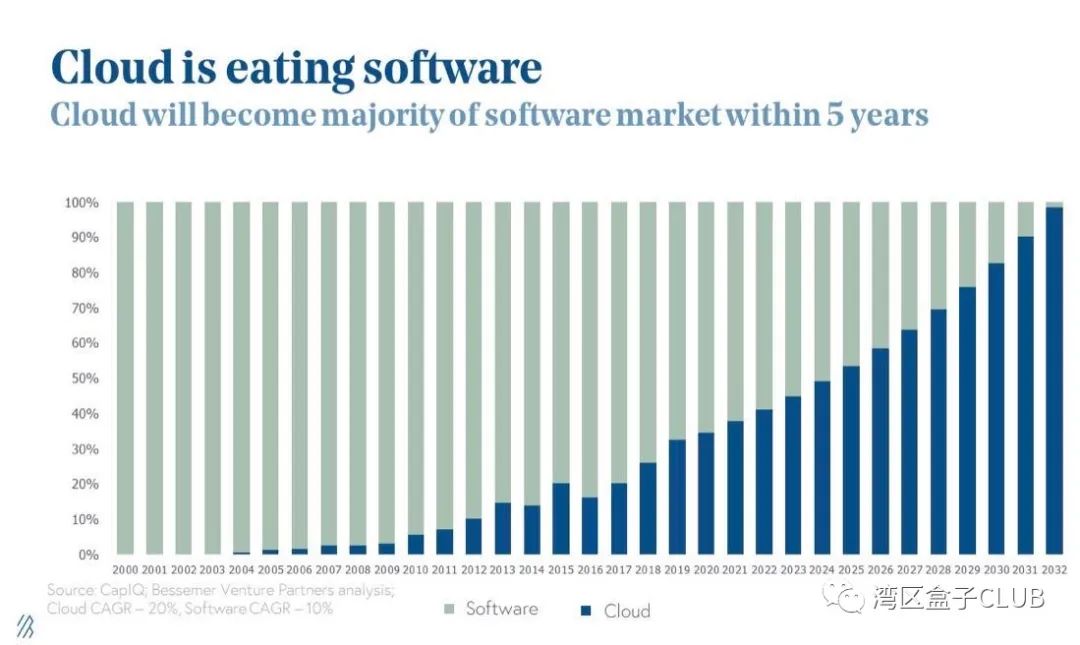

In terms of megatrends, we now and in the future are living in a “cloud first” world. In the past, the industry once made a prediction that “software devours the world”, but now, “cloud devours the world” is becoming a reality.

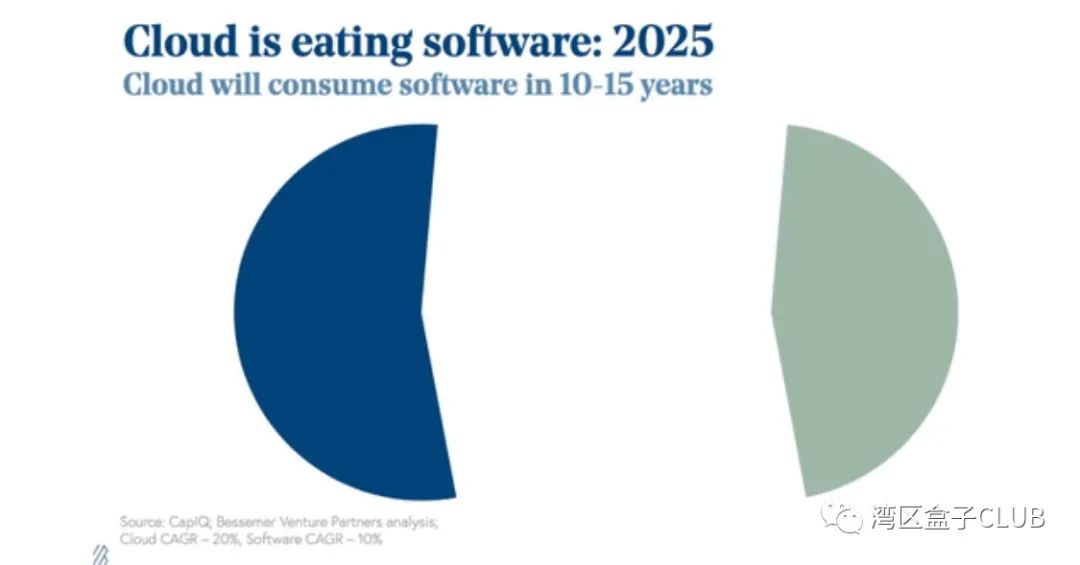

At the current growth rate, the cloud will penetrate almost all enterprise software within a few years. By 2025, the cloud is expected to penetrate 50% of enterprise software; by 2030, the cloud will support more than 75% of software.

In addition to being distributed in the Silicon Valley of the United States, cloud computing-related enterprises are also widely distributed in China, the United Kingdom, Ireland, Germany, Australia, Israel and other global regions. Huge growth opportunities are still calling for the emergence of more companies. [END]